February 10, 2022 — United States

U.S. inflation surged to 7.5% in February 2022, marking the highest annual increase in consumer prices since 1982. This dramatic rise forced companies across the country to urgently reassess pricing strategies, supply chains, and workforce compensation to navigate escalating costs.

The inflation figure, released by the U.S. Bureau of Labor Statistics, reflected broad-based increases in goods and services, with housing, food, and energy costs leading the spike. The surge set off alarm bells in corporate boardrooms and government offices alike, prompting new rounds of economic planning amid uncertainty.

Inflation’s Ripple Effect Across Business Sectors

The inflationary trend reshaped how U.S. companies approached cost management. In sectors from manufacturing to hospitality, business leaders faced tough decisions around pricing and productivity.

Short-term profitability was especially threatened in industries with tight margins, like retail and food services. Business owners were forced to weigh the need to preserve earnings against the risk of alienating price-sensitive customers.

“Every part of our supply chain—from shipping containers to packaging to raw ingredients—has gotten more expensive,” said one Midwestern food distributor. “We’ve had to renegotiate vendor contracts and rethink delivery logistics just to stay competitive.”

Manufacturing companies, heavily reliant on global materials, were particularly exposed. Raw input costs for steel, aluminum, and semiconductors soared, squeezing factory margins. Many firms began pivoting to regional suppliers or bulk ordering strategies to lock in prices.

Meanwhile, technology companies contended with elevated wages amid fierce competition for skilled labor. Rising salaries added further inflationary pressure while also complicating hiring and retention strategies.

Price Adjustments and Consumer Psychology

Retailers and service providers alike grappled with the sensitive task of adjusting prices. While passing increased costs on to consumers was often necessary, businesses also feared losing customers or damaging brand loyalty.

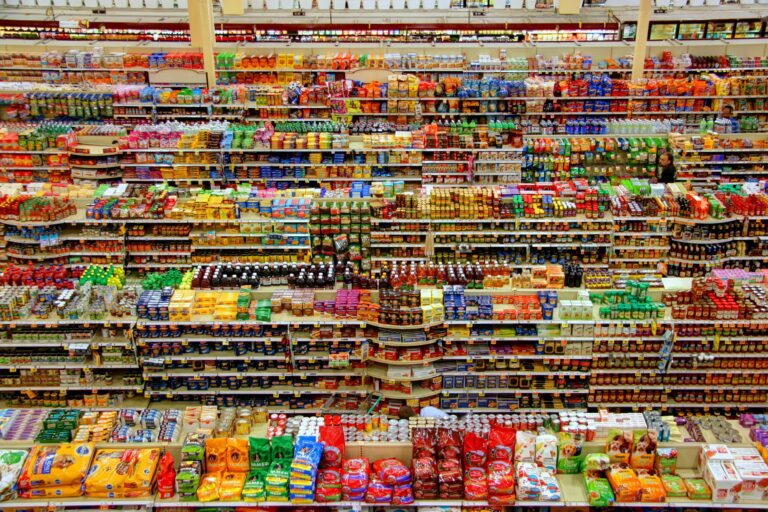

Major supermarket chains and quick-service restaurants began implementing staggered price hikes, hoping that incremental increases would go unnoticed. Others bundled products or added value to justify changes.

“This isn’t just a question of adjusting a few price tags,” said a Boston-based economist. “There’s deep strategic thinking involved in how to maintain customer trust while preserving the bottom line.”

Consumer behavior also began to shift in response. Households re-evaluated discretionary spending and focused on essential purchases. Demand began to fall in certain sectors—particularly luxury goods, leisure travel, and non-essential services—where inflation weakened purchasing power.

Labor Market and Wage Pressures

The inflation spike coincided with a historically tight labor market, amplifying wage demands across multiple industries. Employers increased base pay and offered signing bonuses to attract talent, particularly in transportation, warehousing, and retail.

This wage inflation, in turn, contributed to rising operational costs, creating a feedback loop that complicated economic planning. Small businesses struggled to match the compensation packages of larger corporations, driving concerns about workforce migration.

Some companies began automating processes to offset labor costs, investing in digital ordering systems, robotic warehouse technology, and AI-driven analytics. Others focused on improving employee retention through hybrid work models, wellness programs, and equity incentives.

Strategic Shifts in Supply Chain and Inventory

Persistent disruptions in the global supply chain—exacerbated by pandemic-related factory closures and port delays—fueled inflation further. With input prices rising, many businesses shifted from a just-in-time inventory model to a just-in-case approach, stockpiling goods and building buffer inventories.

Large retailers restructured supplier contracts to lock in prices ahead of future hikes. Domestic sourcing gained momentum, especially in industries vulnerable to overseas bottlenecks, such as electronics and pharmaceuticals.

“Companies that once relied on single-source international suppliers are now investing in redundancy and geographic diversification,” said a logistics strategist. “Inflation has made it clear that agility is as important as efficiency.”

Government and Federal Reserve Response

The inflation report sparked urgent discussions at the Federal Reserve and among policymakers. While the central bank had previously described inflation as “transitory,” the persistence and breadth of the February spike shifted the tone.

Federal Reserve officials signaled a series of interest rate hikes aimed at curbing demand and slowing inflation. Bond yields climbed on expectations of monetary tightening, while Wall Street reacted with increased volatility.

On Capitol Hill, lawmakers debated fiscal interventions to ease consumer burdens, including targeted tax relief and expanded subsidies. However, concerns grew that additional spending might fuel inflation further if not carefully structured.

Long-Term Implications and Forward Strategies

Looking beyond the immediate effects, February’s inflation milestone underscored a new economic reality. Many analysts believe that even as price increases moderate, companies will retain lessons learned in supply resilience, wage competitiveness, and pricing agility.

In response, firms are investing in technology to drive efficiency, diversifying supplier bases to manage volatility, and updating long-term financial models to account for persistent inflation risks.

The episode also renewed focus on consumer trust. Transparent pricing, strong customer communication, and value-driven marketing became priorities as businesses sought to maintain relationships in an era of financial uncertainty.